Veterans State Property Tax Exemptions

Understanding property tax exemptions can save disabled veterans thousands of dollars annually. Each state offers different benefits—ranging from partial exemptions to complete property tax relief—but

Understanding property tax exemptions can save disabled veterans thousands of dollars annually. Each state offers different benefits—ranging from partial exemptions to complete property tax relief—but

There are 4 class action suits you should know about: (and my short summary).

Gain insight into the BVA Hearing process with helpful advice from a Veteran Law Judge.

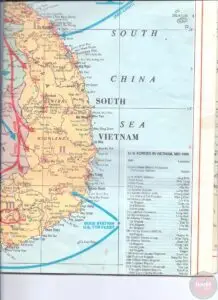

Added to the Agent Orange Presumptive Contions list bladder cancer,

hypothyroidism, and Parkinsonism, or Parkinson-like symptoms.

Member Question: After Reaching 100% Should I File Additional Claims? First a little bit of a back story- I have 44 years combined

VA Compensation and Pension Exams by VES, LHI, and QTC Can I Contact Them Directly?

5 year VA rating protection states that the VA can’t reduce a veteran’s disability that’s been in place for 5 years unless the condition improved

VA Decision Review and VA Appeal Options The legacy VA appeals process has changed to the decision review process. If you disagree with a

OIG substantiated the allegation that Chicago VA regional benefits office employees did not follow VBA procedures when correcting administrative errors. Veterans are not responsible for

Discussion on BVA equitable relief.

Vietnam War Marine Veteran John Ligato breaks down his experience during the Battle of Hue City from an operational view. He discusses what he calls